-

Personal

Banking

Mortgages

-

Agribusiness

Mortgages

Loans

Farm Transition Program

-

Commercial

Banking

Mortgages

Loans

Business Services

-

Investing

Products -

Community

Community Development

Sponsorship and Donations

Financial Literacy

Volunteerism

Community Reports

Scholarships

Building Communities Grant Program

-

About

Our Roots

Our Communities

Annual Reports

Careers

Diversity and Inclusion

- Blog

- Save Money

- Introducing Your Kids to Saving

AUTHOR: TAYLOR BOEHLIG, COMMUNICATIONS AND CONTENT COORDINATOR

We teach our kids various life skills to prepare them for adulthood, but one very important skill is often overlooked: saving money.

It is never too late to start saving, but the earlier in life we start, the stronger the foundation of our saving habits becomes, and the more time our money has to grow.

According to the Child Mind Institute, the ideal time to start teaching your children about money is when they are in the second or third grade. At this time, they have developed basic math skills that allow them to understand the basic principles of saving.

Introducing good saving habits to your kids early is quite simple and will help them become fiscally responsible adults.

Talk to Them

Talking to your kids about money and the importance of saving is the first step in creating good financial habits. Talking about money should not be limited to one conversation. It should be integrated into everyday life, such as including your child in your family’s financial planning.

Ask them to help you decide what to buy at the grocery store or include them in your saving progress for family trips. Discuss what kind of expenses they will have in the future that they will need to save for, like their first car or post-secondary education. There are many ways to expose your child to saving and financial planning.

Open a Bank Account

When you start encouraging your child to save money, this would be the time to trade in the piggy bank for a bank account at your financial institution if you haven’t already. Opening a bank account for your child gives them a secure place to store their money that isn’t easily accessible. Sit down with your child and create a budget that outlines what percentage of their earnings go into their savings account. Sunrise Credit Union offers an account for students from 6 to 25 years old that help save on fees and set the account holder up for success. Click here to learn more about the benefits of Sunrise Credit Union’s Prudent Student account.

Be a Role Model

One of the best ways to instill responsible financial habits in your child is to lead by example. Kids watch everything you do and absorb many of your habits and ideas. Try vocalizing your thought process when deciding to purchase something for yourself, especially if you decide you need to wait until you save more money or if you need to spend that money elsewhere. Show your child that you don’t always buy what you want just because you want it and prioritize your own needs and your family’s needs above wants.

Allow Them to Make Money of Their Own

Paying your child an allowance in exchange for chores may not fit in everyone’s budget; luckily, that is not the only way your child can start earning money. Depending on your child’s age, they could rake leaves, shovel snow, weed gardens, or do other odd jobs for friends, family and neighbours to earn some of their own money. Chores and odd jobs are an excellent way to earn their own money while learning the value of a dollar and introducing them to saving.

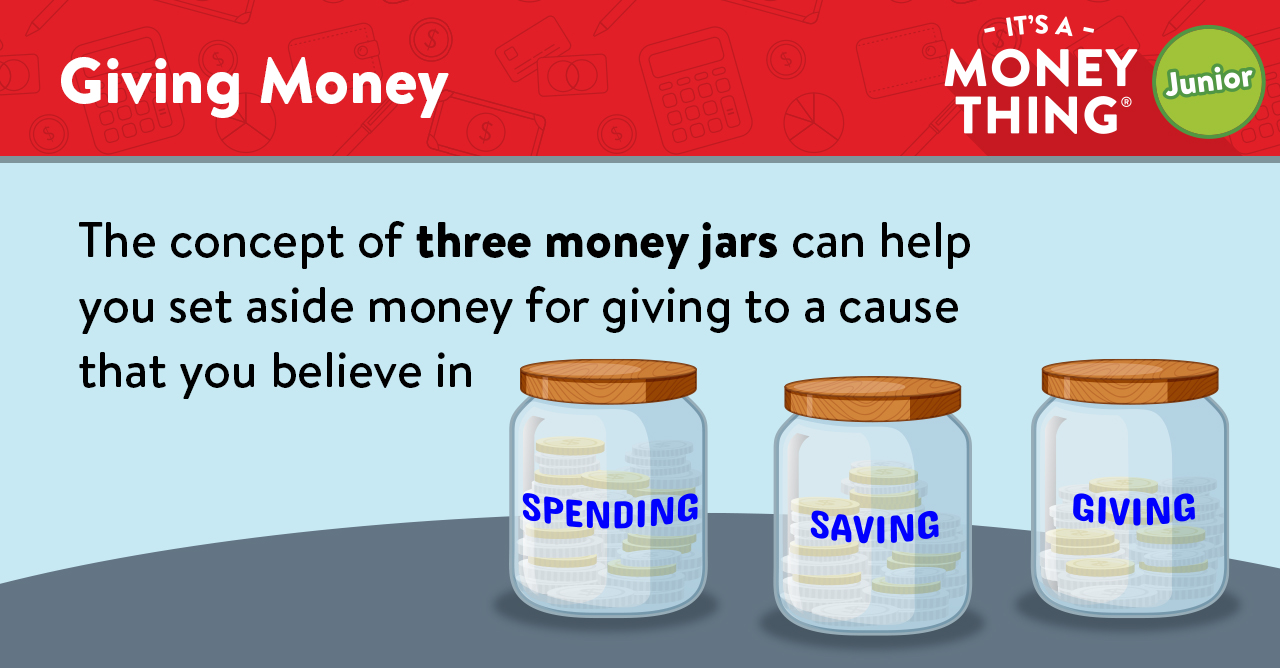

Spending, Saving and Donating

Once your child starts making money, you will need to discuss the basics of what to do with their money. How much should they spend on wants or needs? How much should they be saving and where should they keep it?

These are all great questions to ask your child. Let them think it out and offer suggestions to help them develop a plan to help build their savings and prepare for adulthood. Make a list of things they spend money on and divide them into wants and needs, then decide what percent of the money they should put towards spending and saving. Don’t forget to put a little toward giving. This teaches your child to think about their community and giving back.

Allowing your child to be in charge of their finances is the best way for them to learn. They might make mistakes, but it is essential that they learn these lessons before they become financially independent. See below for some useful resources to help your child learn about saving.