AUTHOR: TAYLOR BOEHLIG, COMMUNICATIONS AND CONTENT COORDINATOR

Banking fees are fees charged by your financial institution for various reasons, including monthly maintenance, insufficient funds, overdraft, ATM, paper statements, foreign transactions, and excess transaction fees.

The first step in avoiding common banking fees is to be aware of them and understand why they are charged. Many common fees can be avoided or reduced with some planning or research into what products or services fit your needs. Here are seven common fees and how you can avoid them:

1. Monthly maintenance and service fees

Banking accounts at most financial institutions do require a monthly service fee. These service fees cover the costs associated with maintaining your account and keeping your funds secure. While maintenance and service fees can sometimes be unavoidable, be sure to do your research and talk to a Member Service Representative at your branch to discuss what account would be the best fit for you. Financial institutions often offer loyalty perks for members with multiple products and services or discounted fees for students or seniors.

2. Insufficient funds fees

Insufficient funds charges are incurred when you overdraw money from your account, and your financial institution declines the transaction. While ensuring you maintain sufficient funds in your account is preferable, that is not always possible with how payment schedules line up. Ask your financial institution about overdraft protection or a line of credit on your account to give yourself an extra layer of protection. Overdraft protection allows you to overdraw your account without incurring insufficient fund fees. However, you will be charged interest on the amount you are overdrawn. A pre-approved line of credit gives you immediate access to funds when needed, and you only pay interest on what you use.

3. Overdraft fees

Overdraft fees are charged when you do not have sufficient funds to cover a transaction. Rather than declining the transaction, like an insufficient funds charge, your financial institution will approve the transaction and charge you a fee plus the amount owed. While this is a temporary solution, it should only be relied upon occasionally. To avoid overdraft fees, consider opening a line of credit on your account or ensuring you maintain a minimum balance to cover any unexpected transactions.

4. ATM Fees

With cashless payment options available in most places, sometimes you may decide to use a nearby ATM. If that ATM is not part of your financial institution’s network, the fees can range from $1 to $9 across Canada, depending on the operator. The easiest way to avoid these fees is to plan ahead and withdraw cash directly from your financial institution, either in-branch or with an ATM on their network. Did you know that all participating credit unions across Canada share a national network of ATMs? This allows credit union members to enjoy ding free ATM transactions nationwide! To find the nearest ding-free® ATM, download our ding-free® locator app on your smartphone, look for the ding-free® decal on participating ATMs, or visit the ding free® website for more information.

5. Paper statements

From the cost of paper, ink, stamps, labour and the environmental impact, paper bank statements are becoming a thing of the past. Many financial institutions charge a fee for printed statements but offer free e-statements that you can access through online banking. E-statements are an easy way to save some money each month and reduce your impact on the environment.

6. Foreign transaction fees

Foreign transaction fees are just that: fees incurred on foreign transactions. These fees can feel unavoidable while travelling. However, there are some steps you can take to reduce them. One option to help you save on foreign transaction fees while travelling is to exchange cash at your local financial institution before leaving Canada. Be sure to practice caution if you are carrying large sums of money while you are travelling. Another option is not using international ATMs without checking the conversion, ATM and home bank fees. If you are a frequent traveller to the United States, consider opening a US chequing account or credit card. Avoid converting your funds back and forth by keeping your USD funds in USD.

7. Excess transaction fees

Some bank accounts are limited in how many transactions can be completed for free per month or are charged per transaction. Avoiding these fees can be relatively simple. If you find yourself paying more than $12 - $15 per month on excess transaction fees, this is a sign for you to look into a different option that fits your needs better. Many financial institutions offer accounts with unlimited transactions for a set cost per month. Another way to avoid these fees is to plan and be aware of the monthly volume of transactions you complete. For example, some accounts, such as HISAs, allow for one free monthly withdrawal and charge $5/withdrawal for the remainder of the month.

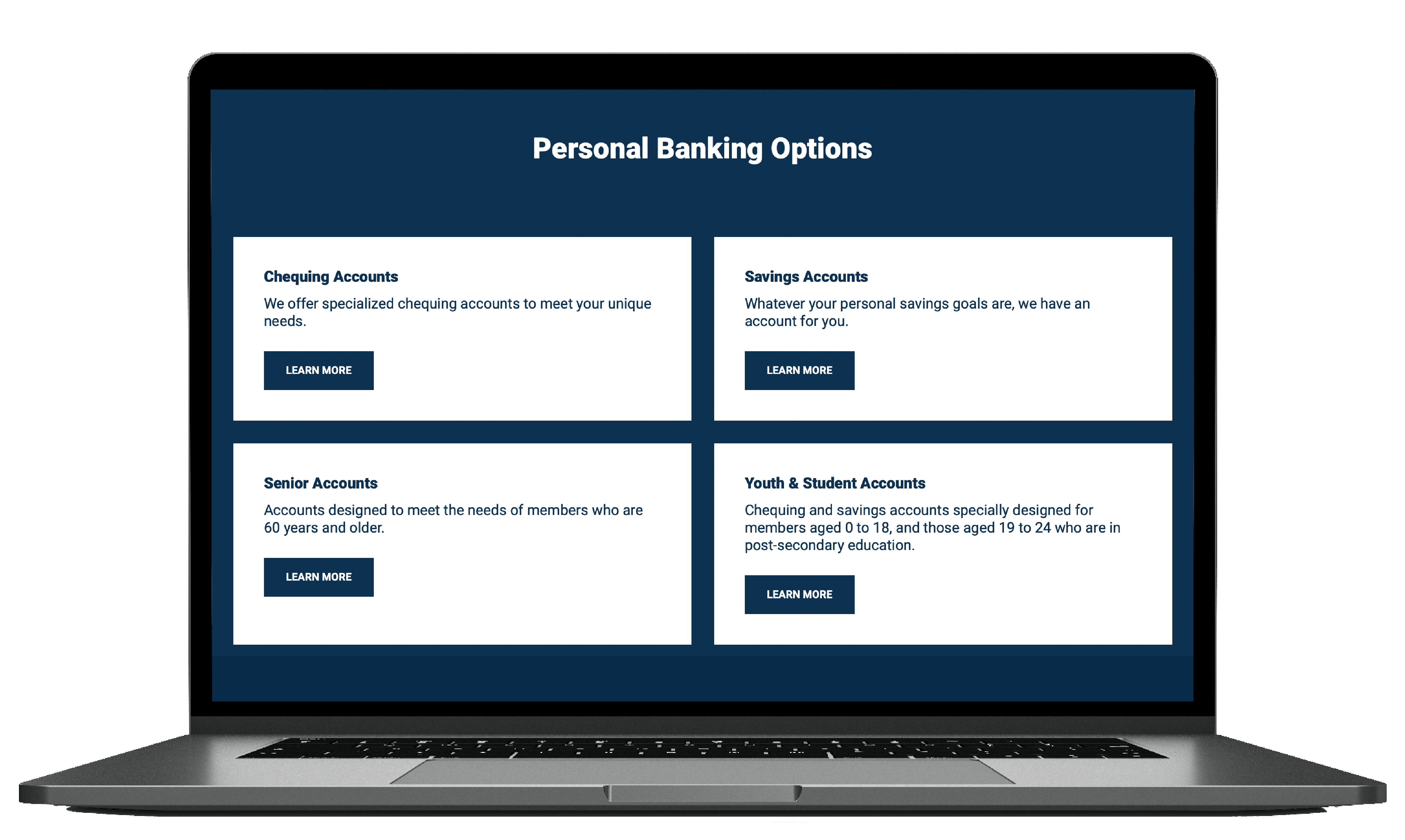

At Sunrise Credit Union, we offer a variety of accounts that feature little to no fees, depending on your age, the number of certain transactions you complete a month, and, in some cases, minimum balances. For example, our Prudent Student account is free for members between the ages of 6 and 25. The Prudent Student account features no charge on the first thirty Interac e-transfers per month. Click here to explore our low, to no-fee chequing accounts like our Loyalty Package, All-In-One Chequing, Golden Chequing, and Personal Chequing.