-

Personal

Banking

Mortgages

-

Agribusiness

Mortgages

Loans

Farm Transition Program

-

Commercial

Banking

Mortgages

Loans

Business Services

-

Investing

Products -

Community

Community Development

Sponsorship and Donations

Financial Literacy

Volunteerism

Community Reports

Scholarships

Building Communities Grant Program

-

About

Our Roots

Our Communities

Annual Reports

Careers

Diversity and Inclusion

Credit Union Frequently Asked Questions

- Blog

- Life Events

- Emergency Fund

AUTHOR: BRUCE LUEBKE, COMMUNICATIONS AND CONTENT COORDINATOR

An emergency fund is an essential part of your finances. Yet, one-third of Canadians have one month or less of expenses in their emergency fund.

An emergency fund is an account that is used to set aside funds to be used in an emergency such as the loss of a job, an illness or a major expense. It’s an easily accessible stash of cash for use ONLY in the case of an emergency.

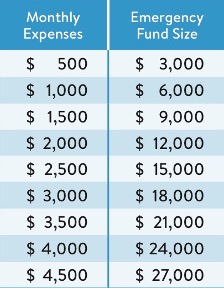

Most financial experts suggest having at least six months' worth of expenses in your emergency fund. Six months' worth of expenses can be an intimidating target, so setting incremental benchmarks can be useful. Start with $500, then $1,000, and so on.

Emergency funds should be a separate category from general savings goals. They should be kept in a separate savings account so there won't be a temptation to spend it, but be accessible so you can access them fast if needed. To allow for your emergency fund to grow, look for a savings account with a decent interest rate, no monthly fee and no minimum balance. A healthy emergency fund takes time to build. Hence, patience is vital, and you should only touch your fund if there's a real emergency.

A healthy emergency fund takes time to build. Be patient, keep reaching for that goal and only touch your fund if there’s a true emergency.

So, what constitutes a real emergency? You can place emergency financial situations into a couple of different categories. Unknown unknowns are things like sudden unemployment, unexpected medical or dental emergencies and accidents. You don't know when they will happen, what they will be, or how much you'll need.

Known unknowns are somewhat predictable expenses, but you don't know exactly when they will happen. Vehicle or home repairs, replacing a major appliance and pet care are examples of known unknowns that you should budget for separately, outside of your emergency fund.

Aside from the knowledge that you have some cash in reserve should you require it, there are other benefits of having an emergency fund. Having confidence to tackle a financial crisis head-on when life presents an emergency that threatens your financial well-being helps keep your stress level down. Keeping money out of your immediate reach keeps you from spending on a whim. It also saves you from making bad financial decisions, including the pitfalls of having to access cash quickly.